5 Grocery Stores Are In For Big Changes In 2025

In December 2024, the CEO of Walmart — the biggest grocery chain in the U.S. and the world's largest retailer — made headlines when he said at a conference that he didn't expect food inflation to ease much in the short term. At least through early 2025, shoppers could expect to see continued high prices on staples like eggs and dairy.

High prices have been the top grocery story of the past couple years, hitting customers everywhere, with inflation even cited as an important factor in the outcome of the 2024 presidential election. (If you're curious, here are the items that grocers mark up the most.) But sticker shock isn't the only important grocery news coming out right now. This is a dynamic time for the country's major supermarket companies, which are trying to make their way through a new world characterized by artificial intelligence and other digital technologies, the rise in home delivery, evolving consumer demands, and concerns over a warming world.

That means big changes are in store for some major grocers in 2025. Amazon, now a major player in the field, will continue to consolidate various corners of its business, from Amazon Fresh to Whole Foods, into a seamlessly integrated delivery operation — or, at least, that's the promise. Chains like Meijer and Aldi are growing both their brick-and-mortar and delivery footprints. And a potential merger between Kroger and Albertsons could spell out a seismic shift in the industry. Here's what to expect from grocery chains in 2025 (and what these changes might mean for you).

The merger between Kroger and Albertsons is dead

Some of the biggest grocery news to usher us into 2025 concerns something that's not actually happening: the proposed $24.6 billion mega-merger between supermarket chains Kroger and Albertsons. In 2022, the two companies announced plans to join forces into what would have been a juggernaut, with 5,000 stores in 48 states — and, just as importantly, the ability to credibly compete with the likes of Amazon and Walmart.

The merger might also have reduced competition, raised consumer prices, and diminished wages and working conditions — at least that was the position of the Federal Trade Commission, which sued to block it. Grocery watchers have been eager to see what the outcome of the suit would be, and on December 10, they got their answer, as courts stopped the deal in a move celebrated by consumer advocates. The erstwhile partners immediately turned on one another, with Albertsons then suing Kroger over allegations that it didn't do enough to ensure the merger's success.

That fight will continue into the next year, while the effects of the failed deal continue to reverberate. According to one analyst writing for ISN Magazine, the FTC's intervention served as both "a warning and a reckoning — a reminder that the U.S. grocery industry is no longer the dominion of a select few." Rather, the industry is in the midst of a battle between the "titans": old-line grocers like Kroger versus newcomers like Amazon and Walmart, poised to continue their domination of the market.

Amazon is becoming the everything store (even further)

Amazon has already become a major food retailer in the U.S. through both its 2017 acquisition of Whole Foods Market and its own grocery division, Amazon Fresh — initially an online delivery service that has started opening brick-and-mortar locations. In 2025, Amazon will likely keep finding ways to combine its offerings, making it easier for customers to shop simultaneously for the non-food retail items on its website, the standard grocery fare of Amazon Fresh, and the specialty and organic goodies at Whole Foods Market.

In Phoenix, Arizona, Amazon is piloting a program in which customers can order seamlessly from all three buckets and receive same-day delivery. Based on preliminary performance, the chain plans to expand this model to more locations. It has also modified 26 Amazon Fresh fulfillment centers to include popular Whole Foods items, as well as in-demand household goods.

In yet another example of Amazon erasing the distinctions between its divisions, the store is piloting a micro fulfillment center at a Pennsylvania Whole Foods. The idea is that shoppers will be able to place a Whole Foods order online (even while they're browsing store aisles) for popular items like Tide Pods or Pepsi that they wouldn't ordinarily find on the store's shelves. A small fulfillment center in the back of the store will package those orders for pickup at checkout, or for home delivery with the rest of the customer's Amazon order.

Aldi increases its footprint in the Southeast — and elsewhere

In 2024, low-cost retailer Aldi announced plans for a major expansion — to the tune of 800 new outlets by 2028 — such that it's currently the fastest-growing grocery chain in the U.S. (via NBC News). At the same time it trumpeted its ambitious plans, Aldi announced that it had acquired Southeastern Grocers, the parent company of Southern chains Winn-Dixie and Harveys Supermarket.

The conversion of some of those stores is already underway, so in 2025, you can look for most of the former Winn-Dixies and Harveys to reopen as Aldi locations in states like Florida, Georgia, and beyond. At the same time, it's not just the South that Aldi has its eye on: The chain is also looking to beef up coverage in the Northeast and Midwest, two regions where it plans to add a total of 330 locations, as well as enter new markets in places like Las Vegas. Based in Illinois with German owners, Aldi currently has more than 2,000 stores across 38 states.

Meijer boosts its home-delivery range in the Midwest

Clearly, many retailers are taking cues from Amazon's domination of the grocery game — Target, for instance, is rumored to be considering a Prime-esque paid membership program. Another way that chains are trying to steal Amazon's thunder? Beefed-up home delivery. Take, for instance, Meijer, a Michigan-based supermarket with more than 500 locations across the Midwest. In December 2024, Meijer announced plans to triple its home delivery service areas, from its current, roughly 20-minute radius to about a 60-minute radius. This will bring some 4 million households within its delivery range.

As it gets this new program off the ground, Meijer is offering free delivery through February 1, 2025, on any general-merch orders over $50, or orders for pet and beauty products over $35. (Though it sells groceries, Meijer is a bit like Walmart in that it sells a lot of other products. Many would argue, in fact, that Meijer laid the groundwork for what Walmart eventually became.) Meijer had also set a goal to cut its carbon emissions in half by 2025, but don't expect to see a big celebration over this in the coming year: The chain actually surpassed that target in 2024 through a combination of wind and solar purchasing, LED lights and other efficient appliances, and greener refrigerant technologies.

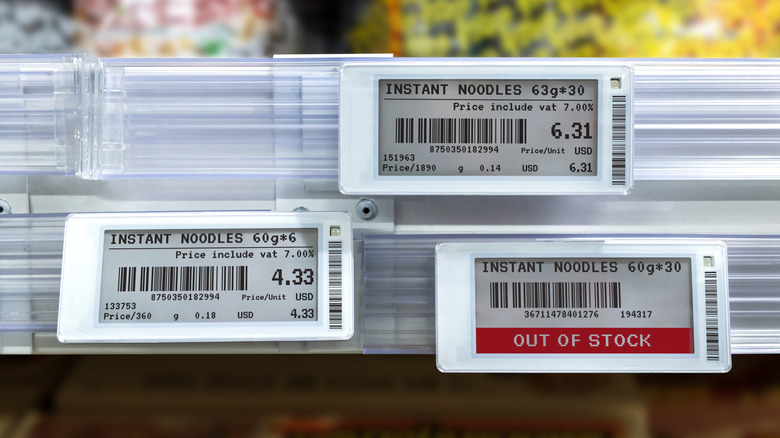

Walmart is rolling out electronic shelf labeling

In the fall of 2024, both Kroger and Walmart denied that they were planning to implement surge pricing after critics raised concerns. Opponents worry that surge pricing could mean, for instance, retailers using digital price tags to opportunistically increase the cost of goods when demand is high, like just before a big storm. Still, Walmart is in the middle of a massive conversion to electronic shelf labels, or ESLs, with plans to deploy the technology across 2,300 stores by 2026 — so expect to see a lot of digital price tags getting affixed to store shelves in the next year. (In the meantime, here are some tips for optimizing your grocery shopping at Walmart.)

So, what does this mean? Proponents of digital shelf labels argue that they're more environmentally friendly and help make shelf restocking easier. And, while some companies deny plans to use electronic labels to implement surge pricing, they've raised the possibility of doing the opposite: easily lowering prices on, for instance, items with looming expiration dates. Supporters also mention the possibility that customers could scan the tags with their phones to learn more about whatever product they're considering buying. Amazon Fresh and Whole Foods have already begun adopting ESL, as have some European retailers.